This is a beta version of the website. Thank you for visiting.

Real Talk: The Hard Questions You Have to Ask Yourself About Your Finances

Let’s face it, when you’re juggling a career, maybe a side hustle, and your personal life, financial health often gets lost in the shuffle. It’s easy to get distracted and get sidetracked from your long-term goals by your short-term needs (and wants).

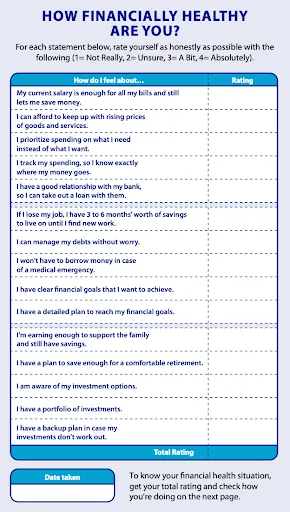

The best way–sometimes the only way–to keep yourself in check is to regularly assess your financial health. It answers these questions:

How’s your financial health?

It reveals your financial strengths (like savings or investments) and weaknesses (such as high debt or insufficient emergency funds) Just like taking care of your physical and mental health, you want to make sure that you’re on top of what’s going on, and that if there’s anything wrong, you catch it early.

What are your financial goals?

It’s the first step in setting realistic and achievable goals. Whether it’s buying a house, saving for retirement, or paying off debt, a clear view of your finances helps in planning these goals effectively. Also, goals are most effective when they’re SMART—specific, measurable, achievable, relevant, and time-bound.

Are you in debt? And will you be able to get out of it?

Knowing your financial health is key to managing debt. It helps in strategizing how to tackle existing debt and avoiding potential debt traps.

Are you prepared for the unexpected?

Life is unpredictable. Assessing your financial health helps you ensure you have an emergency fund to cover unexpected expenses like medical emergencies or job loss, reducing stress, and providing security.

Can't find what you're looking for?

CLICK HERE TO SEARCH KEYWORDS