This is a beta version of the website. Thank you for visiting.

Two Strategies That Will Help You Build A Solid Budgeting Habit

Pinoys love using the word “budget,” but we tend to associate it with negative emotions as in “‘di kaya ng budget, eh,” meaning it’s unattainable, at least at the moment, or something that is “less,” or cheap as in “‘yung budget lang, ha?” or “budget meal” meaning something that has lesser value than the full version and therefore more affordable.

When it’s used in conversations involving managing money, we tend to feel intimidated and feel like it’s too serious an undertaking, and you need to have advanced personal finance knowledge to successfully do it.

But because you have dreams and aspirations, budgeting is a key #Adulting activity. Picture your budget as a tool that will let you achieve your goals. The more realistic it is, the higher your chances of success. For a budget to be realistic, it should reflect your actual financial situation — your income, your expenses, your financial goals — while being flexible enough to adapt to surprises.

To start, you must first identify your goals.

Do you want to pay off your debt? Do you want to save a down payment for a home? Or finally take that dream vacation?

When you’re thinking about your goals, don’t police yourself, all your goals are valid (read this article. And they must be SMART—Specific, Measurable, Achievable, Relevant, and Time-bound.

For example, a SMART financial goal might be saving PHP100,000 for a vacation in two years. This goal is specific (a vacation), measurable (PHP100,000), achievable (based on your income and expenses), relevant (fulfilling your desire for leisure), and time-bound (two years).

Next, find the type of budgeting that works for you.

The thing with creating a budget is that you’ll need to follow through for it to work. To ensure that it sticks, choose a type that fits your personality, income, and lifestyle best.

1. 50-30-20 Budget

What is it? This method follows the 50-30-20 rule: 50% of your income goes to essential expenses (like rent and food), 30% to wants (such as entertainment), and 20% to savings and investments.

Who is it for? Ideal for those with disposable income aiming to build a healthy savings or investment fund.

Pros and cons: The allocations may not be for everyone or every budget and lifestyle. But, they are flexible, with variations like 60-20-20 or 70-20-10 to better suit different lifestyles.

2. The Cash Envelope Budget

What is it? This involves allocating cash into labeled envelopes for different expenses.

Who is it for? Great for beginners in budgeting.

Pros and cons: It controls overspending but requires discipline, as it can be tempting to spend cash once it’s withdrawn. You can also do this digitally via automatic transfers.

3. Reverse Budgeting

What is it? This approach prioritizes savings before other expenses.

Who is it for? Suitable for those with sufficient disposable income but struggling to save.

Pros and cons: It’s excellent for prioritizing savings but demands extra spending discipline.

4. The Values-Based Budget

What is it? Focuses on spending on things that matter most to you, cutting out less important expenses.

Who is it for? Perfect for individuals with clear financial goals, like saving up for a new home or paying off debt.

Pros and cons: Allows for covering essential expenses and financial obligations while saving for key goals. However, it requires discipline to forego smaller pleasures for more significant, value-adding expenses.

5. The No-Spending Budget

What is it? Prioritizes bill payments and savings, with minimal other spending.

Who is it for? Ideal for those short on funds or saving for a significant purchase.

Pros and cons: Effective for short-term savings goals or debt repayment, but challenging to maintain long-term due to potential emergencies or unforeseen expenses.

Think of your budget as a dynamic tool, evolving as you do. It’s not about limitations—it’s about making informed decisions that push you toward achieving your goals, big and small, long-term or short-term.

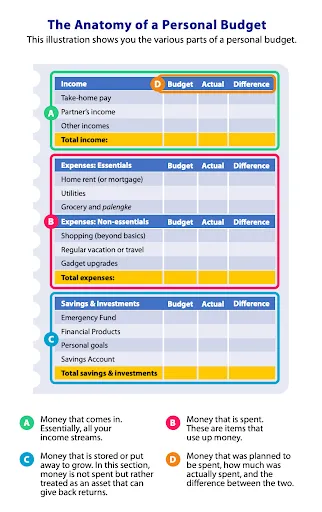

To help you visualize your budget, here’s a sample from Chapter 3 of Moneybility, “Your Journey Starts with a Budget.” And here’s a sample income and expense tracker that you can copy and customize.

Learn more about taking control of your budget:

Can’t find what you’re looking for?

Click here to search keywords